Here's an interesting piece of commentary from Wall Street Journal writer Christina Binkley, where she talks about how the new trend of private equity investors is affecting luxury goods companies. While she feels that "the jury is still out on whether these new investors will improve the luxury business", she does make some smart observations about the pros and cons of such partnerships and what this new era of fashion financing means for consumers.

Pros

The recent negotiations for Valentino have been conducted without so much as consulting with Valentino Garavani, the brand's 75-year-old designer and founder. It isn't clear whether Mr. Garavani would stay with Valentino after control of the company changes hands. In a corporate world, designers are no longer stars but employees. Witness Gucci. Despite a fierce outcry from fans, Gucci replaced iconic designer Tom Ford with the little-known Frida Giannini. Far from a fiasco, the move actually improved sales.

One of the more intriguing things that these investors can do is revive dying brands. Azzaro, a Paris fashion house founded by former-couturier Loris Azzaro, is set for a comeback now that it is owned by Barcelona's Reig Capital Group, which manages the money of a rich Andorran family

Cons

Growing revenue means opening new stores - and we're seeing store openings fêted from Moscow to Mumbai these days. This offers convenience for consumers and more opportunities to buy. But finding Bally shoe stores in Beijing and Bahrain alike also smacks a bit of Gap.

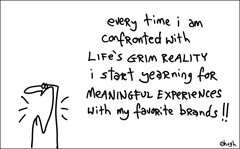

One of the first things private-equity investors do is start producing high-profit-margin products like purses, scents, jewelry and watches. But these days, handbag-making is more about the label than the expertise - and the focus is no longer on the highest quality but the highest return on investment.

I couldn't agree more.

Image courtesy: The Augusta Chronicle

No comments:

Post a Comment